Cryptocurrency Payment Gateways Development are revolutionizing the way businesses process transactions. These solutions enable merchants to accept digital currencies like Bitcoin, Ethereum, and stablecoins, offering a seamless and secure payment experience.

Integrating crypto payments is becoming increasingly important as digital currencies gain mainstream acceptance. Businesses benefit from lower transaction fees, faster cross-border payments, and enhanced security through blockchain technology. Moreover, cryptocurrency transactions eliminate chargebacks, reducing the risks associated with fraudulent activities.

The market for digital payments is experiencing rapid growth, driven by rising consumer demand and technological advancements. Reports suggest that global crypto transactions are set to increase significantly in the coming years, with more businesses adopting decentralized financial solutions. As a result, developing a reliable crypto payment gateway is a crucial step for businesses looking to stay ahead in the digital economy.

Difference Between Traditional Payment Gateway and Cryptocurrency Payment Gateway

As digital transactions continue to evolve, businesses are exploring innovative payment solutions to streamline transactions. Cryptocurrency Payment Gateway Development has emerged as a game-changer, offering faster, more secure, and cost-effective transactions compared to traditional payment gateways. Below, we explore the key differences between these two systems.

1. Key Distinctions in Transaction Processing

Traditional Payment Gateway

- Traditional payment gateways rely on banks and financial institutions to process transactions. This involves multiple verification steps, which can lead to delays, especially for international transactions.

- These gateways typically impose high transaction fees due to the involvement of banks, credit card companies, and third-party processors.

- Transactions can take anywhere from a few hours to several days, depending on banking regulations, operational hours, and international transfer policies.

Cryptocurrency Payment Gateway

- Cryptocurrency Payment Gateway Development eliminates intermediaries by allowing direct peer-to-peer transactions. Payments are processed through blockchain networks, reducing the time required to complete a transaction.

- With no involvement of banks or third-party processors, transaction fees are significantly lower. This is especially beneficial for businesses handling a high volume of international transactions.

- Transactions are completed within minutes, regardless of geographical location, making cryptocurrency payment gateways a more efficient alternative.

2. Security and Decentralization Factors

Traditional Payment Gateway

- Traditional payment gateways operate on centralized networks, where all transaction data is stored on a single server. This centralized system makes them more vulnerable to hacking, fraud, and data breaches.

- Personal and financial information is stored by banks and payment processors, increasing the risk of identity theft and unauthorized access.

- Fraudulent chargebacks are a common issue with traditional gateways, often causing financial losses for businesses.

Cryptocurrency Payment Gateway

- Cryptocurrency Payment Gateway Development leverages blockchain technology, which ensures decentralization and security. Transactions are recorded on a distributed ledger, reducing the risk of a single point of failure.

- Payments made through a cryptocurrency payment gateway are encrypted and verified by multiple nodes, making them highly resistant to fraud and hacking attempts.

- Unlike traditional payment methods, transactions are irreversible, eliminating the risk of chargeback fraud and protecting businesses from financial losses.

3. Benefits of Blockchain Technology

Transparency and Trust

- Cryptocurrency Payment Gateway Development utilizes blockchain technology, which ensures transparency by recording every transaction on an immutable ledger.

- Unlike traditional payment gateways, where transaction data is controlled by banks, blockchain technology provides a public record of all transactions, making them easily verifiable.

- This level of transparency reduces disputes and enhances trust between merchants and customers.

Lower Transaction Costs

- Traditional payment gateways require merchants to pay fees for credit card transactions, international payments, and third-party processing. These fees can add up, increasing overall costs for businesses.

- A cryptocurrency payment gateway eliminates these intermediaries, significantly reducing transaction fees. This allows businesses to save money while offering customers a cost-effective payment option.

Global Accessibility

- Traditional payment systems require currency conversion and compliance with different banking regulations, which can cause delays and additional costs.

- With Cryptocurrency Payment Gateway Development, businesses can accept payments from customers worldwide without worrying about currency exchange rates or cross-border restrictions.

- Cryptocurrencies operate on a decentralized network, making transactions seamless and accessible to users in any part of the world.

Types of Cryptocurrency Payment Gateways

As digital currencies gain popularity, businesses are adopting Cryptocurrency Payment Gateway Development to enable secure and seamless transactions. Different types of crypto payment gateways cater to various business needs. Here’s a breakdown of the key categories:

1. Centralized vs. Decentralized Solutions

Centralized Gateways

These rely on third-party providers to process digital transactions. They manage security, compliance, and customer support, making them a convenient option for businesses new to accepting cryptocurrencies. Acting as intermediaries, they ensure smooth transactions and regulatory compliance.

However, using a centralized system means businesses must trust a provider with transaction data, which may pose security risks. Additionally, processing fees apply.

Decentralized Gateways

A decentralized approach operates on blockchain networks without intermediaries. Merchants retain full control over funds and transactions, reducing risks related to fraud, censorship, and unauthorized access.

With enhanced security, privacy, and lower fees, this option is ideal for businesses prioritizing financial independence.

2. Hosted vs. Non-Hosted Solutions

Hosted Payment Gateways

These are managed by external providers, requiring customers to complete transactions on a separate platform. They offer easy integration, security, and customer support, making them a hassle-free option for businesses.

However, merchants have limited control over transaction processes.

Non-Hosted Payment Gateways

This solution integrates directly into a business’s website or app, giving full control over transactions, funds, and security measures. While requiring technical expertise, it offers greater flexibility and lower fees over time.

3. Open-Source vs. Proprietary Systems

Open-Source Solutions

These allow businesses to customize and modify payment systems based on their needs. Transparency is a key advantage, as publicly available code reduces the risk of hidden vulnerabilities. Many companies choose open-source solutions for their cost-effectiveness and flexibility.

Proprietary Systems

Developed by private companies, these provide exclusive features, enhanced security, and dedicated customer support. While licensing fees may apply, they ensure a user-friendly experience and seamless integration for businesses seeking a reliable and well-supported payment system.

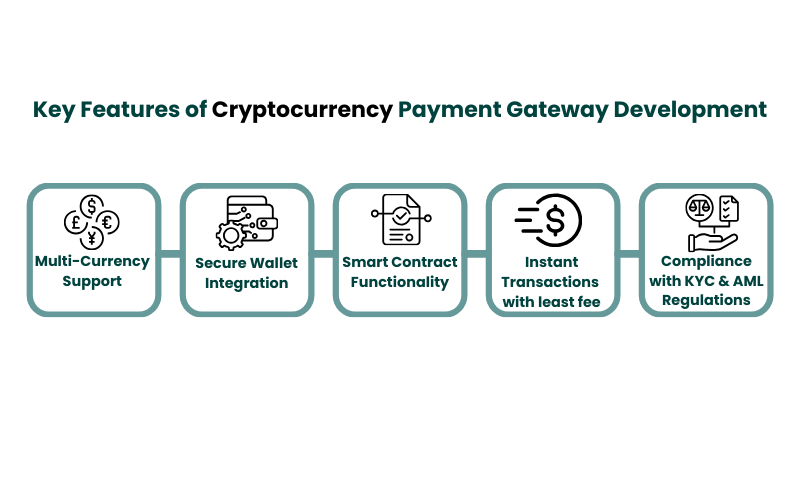

Key Features of Cryptocurrency Payment Gateway Development

As digital payments evolve, businesses are increasingly adopting crypto payment solutions to facilitate seamless and secure transactions. A well-developed gateway offers multiple advanced features, ensuring efficiency, security, and compliance.

1. Multi-Currency Support

One of the essential aspects of a crypto payment system is multi-currency support. Businesses need to accept various digital assets such as Bitcoin, Ethereum, and Litecoin to cater to a diverse customer base. Supporting multiple cryptocurrencies allows companies to expand globally, offering customers flexibility in transactions while reducing reliance on traditional banking systems.

2. Secure Wallet Integration

A robust solution must provide secure wallet integration to safeguard users’ funds. Whether using hot wallets (online) or cold wallets (offline), the integration should allow seamless storage, transfer, and management of digital assets while protecting against cyber threats. Strong security measures enhance trust and reliability.

3. Smart Contract Functionality

A key innovation in blockchain-based payment solutions is the implementation of smart contracts. These self-executing agreements automate transactions based on predefined conditions, eliminating the need for intermediaries. Smart contracts enhance transparency, security, and accuracy while reducing fraud risks and human errors.

4. Instant Transactions with Minimal Fees

Unlike traditional financial networks that involve multiple intermediaries and high processing fees, blockchain technology enables real-time transactions at significantly lower costs. The decentralized nature of blockchain ensures fast payments, reducing delays and improving cash flow for businesses. The absence of third-party processors further minimizes expenses, making it a cost-effective option.

5. Compliance with KYC & AML Regulations

To prevent fraud and ensure adherence to financial regulations, crypto payment solutions must comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) policies. These measures verify user identities, monitor transactions, and prevent illegal financial activities. Compliance builds trust, ensures legal operations, and enhances security.

Benefits of Cryptocurrency Payment Gateway Development

With the rise of digital currencies, crypto payment solutions are transforming online transactions by offering businesses a secure and efficient way to accept payments. Here are the key benefits:

1. Borderless Transactions for Global Businesses

One of the biggest advantages of crypto payment systems is their ability to facilitate international transactions without restrictions. Traditional banking often imposes limits on cross-border payments, leading to delays and high conversion fees. However, blockchain-based solutions enable businesses to accept payments worldwide without currency exchange hassles. This makes them ideal for global e-commerce platforms, freelancers, and service providers.

2. Lower Transaction Fees Compared to Traditional Methods

Credit card processors and banks charge hefty fees for processing payments, reducing business profits. Crypto payment solutions significantly lower these costs by eliminating intermediaries such as banks and financial institutions. Since transactions operate on decentralized networks, businesses can process payments at a fraction of the cost, allowing them to save money while offering competitive pricing to customers.

3. Enhanced Security with Blockchain Encryption

Security remains a major concern in online payments, but blockchain technology provides a highly secure alternative. Every transaction is encrypted and tamper-proof, making it resistant to fraud. Unlike traditional gateways that store sensitive customer data, crypto transactions do not require personal information, reducing the risk of data breaches and identity theft. This enhances trust and reliability for both businesses and customers.

4. Faster Settlements and No Chargebacks

Banking systems often take days to process payments, causing cash flow delays. With blockchain-based transactions, payments are processed instantly, allowing businesses to receive funds in real-time. Additionally, crypto payments are irreversible, eliminating chargebacks and fraudulent refund claims. This ensures that merchants do not lose revenue due to disputed transactions, making it a highly beneficial feature for online businesses.

By adopting these advanced payment solutions, businesses can enhance efficiency, security, and global reach while reducing costs.

Top 5 Cryptocurrency Payment Gateways

As businesses increasingly adopt digital currencies, crypto payment solutions have become essential for seamless and secure transactions. Here are five top platforms that offer efficient payment processing for businesses worldwide.

1. Binance Pay

Binance Pay is a leading solution that allows merchants to accept digital asset transactions without any fees. It supports multiple cryptocurrencies and ensures instant, borderless transfers. As part of the Binance ecosystem, it offers high liquidity and security, making it a trusted choice for businesses. Its seamless integration with e-commerce platforms enhances the checkout experience for global customers.

2. BitPay

BitPay is one of the most established platforms in the crypto payments industry. It enables businesses to accept Bitcoin, Ethereum, and other major digital assets while offering automatic conversion to traditional currencies. With strong fraud protection, easy invoicing, and direct bank deposits, BitPay provides a secure and convenient way for businesses to integrate blockchain-based payment solutions.

3. CoinGate

CoinGate supports over 70 digital currencies, including Bitcoin, Litecoin, and Ethereum. It allows merchants to receive payments in crypto or convert them into fiat. With features like API integration, point-of-sale (POS) solutions, and plugin support for e-commerce platforms, CoinGate simplifies payment processing for businesses of all sizes.

4. Coinbase Commerce

Developed by Coinbase, this platform provides high security, instant transactions, and seamless integration with Shopify, WooCommerce, and other online stores. Businesses can accept Bitcoin, Ethereum, and other cryptocurrencies while benefiting from Coinbase’s trusted infrastructure. Its user-friendly setup ensures a smooth and reliable payment experience.

5. NOWPayments

NOWPayments is a non-custodial service supporting over 200 cryptocurrencies, offering businesses complete flexibility. It provides automatic coin conversion, API integration, and multi-currency support, making it ideal for e-commerce stores, gaming platforms, and service providers. With low transaction fees and easy setup, NOWPayments helps businesses leverage blockchain technology for efficient digital payments.

By integrating these solutions, businesses can enhance security, reduce costs, and expand globally while providing customers with more payment options.

Steps to Develop a Cryptocurrency Payment Gateway

With the rising demand for digital transactions, crypto payment solutions have become essential for businesses looking to accept digital assets securely. Here are the key steps to building an efficient gateway:

1. Research & Market Analysis

Before development begins, conducting thorough research and market analysis is crucial. Understanding the latest trends in blockchain transactions, user preferences, and regulatory frameworks helps in designing a system that meets industry standards. Businesses should also analyze competitors to identify key features that enhance decentralized payments.

2. Choosing the Right Blockchain Technology

Selecting the most suitable blockchain is a critical step. Networks like Ethereum, Binance Smart Chain, and Solana offer different advantages in terms of transaction speed, scalability, and cost. The choice of blockchain impacts the efficiency of API integration, smart contracts, and overall security in transaction processing.

3. Developing a Secure API for Transactions

A well-designed API plays a key role in ensuring smooth communication between merchants, customers, and blockchain networks. It facilitates instant settlements, processes payments in real time, and ensures data security. Supporting multiple cryptocurrencies allows businesses to offer diverse payment options to their customers.

4. Integrating Wallets and Smart Contracts

For seamless transactions, integrating secure wallets and automated contracts is essential. Wallets enable users to store and manage digital assets, while smart contracts execute transactions automatically, reducing fraud risks. A multi-currency system ensures flexibility and an enhanced user experience.

5. Implementing Security Protocols and Compliance Measures

Security is a top priority in crypto payment processing. Implementing encryption, two-factor authentication, and fraud detection mechanisms ensures safe transactions. Additionally, businesses must comply with AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations to prevent illegal activities and maintain legal compliance.

6. Testing and Deployment

Before launching, extensive testing is necessary to identify vulnerabilities and optimize performance. Security audits, load testing, and transaction simulations help ensure that digital transactions are processed smoothly. Once testing is complete, the solution can be deployed for real-world use, allowing businesses to accept crypto payments efficiently.

By following these steps, businesses can build a secure and reliable system that enhances transaction efficiency while ensuring compliance with industry standards.

Using Off-the-Shelf vs. Custom Cryptocurrency Payment Gateway

As digital currencies gain popularity, Cryptocurrency Payment Gateway Development has become essential for businesses accepting crypto payments. When choosing a payment gateway, businesses must decide between off-the-shelf solutions and custom-built options. Each has its advantages and drawbacks.

Pros and Cons of Ready-Made Solutions

Off-the-shelf crypto payment gateways are pre-built solutions that allow businesses to start accepting cryptocurrency payments almost instantly. These solutions are ideal for startups or small businesses that need a quick and cost-effective way to process decentralized payments.

Advantages:

- Faster deployment – No need for extensive development, making it easy to integrate.

- Cost-effective – Lower upfront costs compared to a custom-built gateway.

- Security features included – Most ready-made gateways come with built-in secure payment processing mechanisms.

- Regulatory compliance – Many providers ensure compliance with AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations.

Disadvantages:

- Limited customization – Businesses may not be able to modify features to suit specific needs.

- Higher transaction fees – Some providers charge higher fees per transaction, reducing profitability.

- Potential security risks – Since multiple businesses use the same solution, vulnerabilities may exist.

- Restricted blockchain support – Some ready-made gateways may not support all cryptocurrencies or blockchain networks.

While off-the-shelf solutions are convenient, they may not be suitable for businesses looking for a unique and scalable crypto payment gateway.

Advantages of Custom-Built Crypto Gateways

For businesses that require greater flexibility, a custom Cryptocurrency Payment Gateway Development solution is the best choice. A custom-built payment gateway allows companies to design a system that meets their exact needs, ensuring seamless crypto transactions and top-tier security.

Benefits of a Custom Crypto Gateway:

- Full control over features – Businesses can integrate functionalities like smart contract payments, multi-currency support, and faster instant crypto settlements.

- Enhanced security – Custom solutions can include advanced encryption, fraud detection, and two-factor authentication.

- Scalability – As businesses grow, a custom gateway can be upgraded to handle increased transaction volumes.

- Reduced transaction fees – No reliance on third-party services, lowering overall operational costs.

- Integration with specific blockchain networks – Businesses can choose a blockchain that suits their needs, such as Ethereum, Binance Smart Chain, or Solana.

Developing a custom Bitcoin payment gateway or a multi-currency payment system requires significant investment but provides long-term benefits for businesses looking to scale.

When to Choose a Custom Solution

A custom Cryptocurrency Payment Gateway Development solution is ideal for:

- Large enterprises – Businesses handling high transaction volumes can benefit from lower fees and better optimization.

- Companies requiring unique features – If a business needs specialized functionality, like a crypto wallet API, a custom gateway is the way to go.

- Businesses prioritizing security – If security is a top concern, a custom-built solution ensures complete control over encryption and fraud prevention.

- Merchants needing blockchain flexibility – If a business wants to support multiple blockchains and cryptocurrencies, a custom gateway allows full control over integration.

Why Do You Need to Invest in Custom Cryptocurrency Payment Gateway Development?

In the rapidly evolving digital economy, businesses must adopt secure and efficient payment solutions. A custom-built crypto payment system provides additional benefits that enhance security, scalability, and competitiveness.

Tailored Security Measures for Business Needs

Security is a top priority in digital transactions. A customized solution allows businesses to implement advanced encryption, fraud detection, and multi-factor authentication. Additionally, ensuring compliance with AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations helps maintain legal adherence while protecting against financial crimes.

Scalability and Flexibility in Payment Processing

A tailored gateway offers scalability to handle increasing transaction volumes while supporting multiple digital assets like Bitcoin, Ethereum, and stablecoins. Seamless integration with wallet APIs, automated smart contracts, and real-time settlements enables businesses to process decentralized transactions efficiently. This flexibility makes custom-built solutions ideal for enterprises looking to scale.

Competitive Advantage in the Digital Economy

Investing in a personalized crypto payment system helps businesses stand out by offering fast, cost-effective, and user-friendly solutions. A Bitcoin-compatible gateway with unique features, lower fees, and blockchain integration ensures a smooth experience for merchants and customers alike. This innovation attracts more users and drives revenue growth in the fast-paced digital marketplace.

By developing a tailored system, businesses can optimize security, enhance scalability, and gain a strong competitive edge in the world of digital transactions.

Cost of Developing a Cryptocurrency Payment Gateway

Investing in a crypto payment system is essential for businesses looking to process digital transactions securely and efficiently. However, development costs can vary based on several factors. Understanding these key elements helps businesses plan effectively.

Factors Influencing Development Costs

1. Features & Functionality

The complexity of a system impacts its cost. Basic solutions handle simple transactions, while advanced platforms include:

- Support for multiple digital assets like Bitcoin, Ethereum, and stablecoins

- Automated smart contracts for secure and transparent processing

- Instant settlements to minimize delays and improve merchant convenience

- Wallet API integration for seamless fund transfers

2. Security Measures

Security is a top priority in financial transactions. Implementing features such as encryption, two-factor authentication, fraud detection, and compliance with AML/KYC regulations increases costs but ensures strong protection against cyber threats.

3. Blockchain Integration

The choice of blockchain networks affects development expenses. Supporting multiple chains, such as Ethereum, Binance Smart Chain, and Solana, requires additional resources. A Bitcoin-focused system may have different technical requirements compared to platforms handling various altcoins.

By considering these factors, businesses can make informed decisions about building a secure and scalable transaction processing system that aligns with their needs and budget.

Estimated Cost Breakdown

The total cost of cryptocurrency payment gateway development varies depending on complexity:

1. Basic Payment Gateway – $25,000 to $50,000

- Supports a single cryptocurrency

- Basic security features

- Simple UI/UX

2. Mid-Level Solution – $50,000 to $100,000

- Multi-currency support

- Customizable security features

- Smart contract integration

- Enhanced API for seamless payments

3. Enterprise-Grade Gateway – $100,000+

- Advanced secure payment processing

- Decentralized payments with full control over security and compliance

- Scalability to handle high transaction volumes

- Integration with multiple blockchains and crypto wallet APIs

Budgeting Tips for Businesses

To minimize costs and maximize efficiency in cryptocurrency payment gateway development, businesses should:

- Prioritize essential features – Start with basic functionalities and expand as needed.

- Use open-source solutions – Leverage existing crypto wallet APIs to reduce custom development time.

- Partner with experienced developers – Work with blockchain experts to ensure smooth, cost-effective implementation.

- Plan for scalability – Choose a solution that grows with business needs to avoid high future upgrade costs.

Conclusion

The future of crypto payments and business adoption is bright, making Cryptocurrency Payment Gateway Development essential. To get started, define your needs and partner with experienced developers like Silver WebBuzz. They can guide you through the process, whether you choose an off-the-shelf or custom solution. Selecting the right approach is crucial; prioritize security, speed, and user experience. Silver WebBuzz can help you navigate this evolving landscape, ensuring your gateway aligns with your business goals and capitalizes on the growing acceptance of digital currencies.