The digital transformation has impacted nearly every sector, and the insurance industry is no exception. With smartphones becoming an integral part of daily life, insurance companies are capitalizing on the opportunity to provide customers with seamless mobile experiences. Insurance Mobile App Development is no longer a luxury but a necessity to stay competitive in the rapidly evolving market. This post will explore the importance of developing an insurance mobile app, key features, technologies involved, benefits, challenges, and how you can effectively develop an insurance app for your business.

Why Insurance Mobile App Development is Essential?

The need for mobile apps in the insurance sector has surged in recent years. Customers are increasingly seeking more convenience and personalized services, which can only be provided through mobile apps. Here’s why insurance mobile app development is essential:

- Changing Customer Expectations: Today’s consumers expect quick and easy access to their insurance details, 24/7. Mobile apps offer the flexibility to view policies, file claims, and make payments at any time.

- Mobile-First Solutions: With mobile usage on the rise, a mobile app becomes an important touchpoint for insurers to reach their customers, increasing engagement and satisfaction.

- Efficiency and Cost Savings: Insurers can streamline their processes, reduce administrative overhead, and provide faster claims processing, which ultimately saves costs.

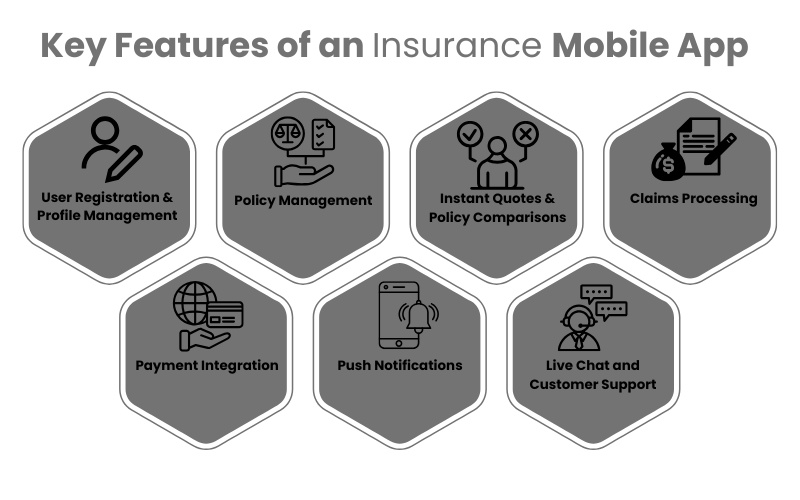

Key Features of an Insurance Mobile App

A successful insurance mobile app needs to deliver value to both the users and the insurance company. Here are the key features that can make an insurance mobile app stand out:

1. User Registration & Profile Management:

- Allow users to easily sign up, create their profiles, and verify their identity.

- Enable users to manage personal information, policy details, and other essential data in one place.

2. Policy Management:

- Users should be able to view their policies, track renewals, and make updates directly through the app.

- A clear and simple interface for policy management increases user engagement.

3. Instant Quotes & Policy Comparisons:

- Enable customers to get instant quotes by entering basic information like their location, age, and type of coverage.

- Offer the ability to compare policies from different providers to help customers make informed decisions.

4. Claims Processing:

- A simple and efficient way for users to file claims, upload documents, and track the status of their claims.

- A push notification feature can alert users about updates to their claims.

5. Payment Integration:

- Allow users to make premium payments directly through the app.

- Integration with multiple payment gateways provides flexibility and security.

6. Push Notifications:

- Send reminders for policy renewals, payments, claim updates, and other important events.

7. Live Chat and Customer Support:

- Offering live chat support or AI-driven chatbots ensures that users have real-time help and answers to their questions.

- With a chatbot, insurers can offer 24/7 assistance for common queries like policy updates and claim status.

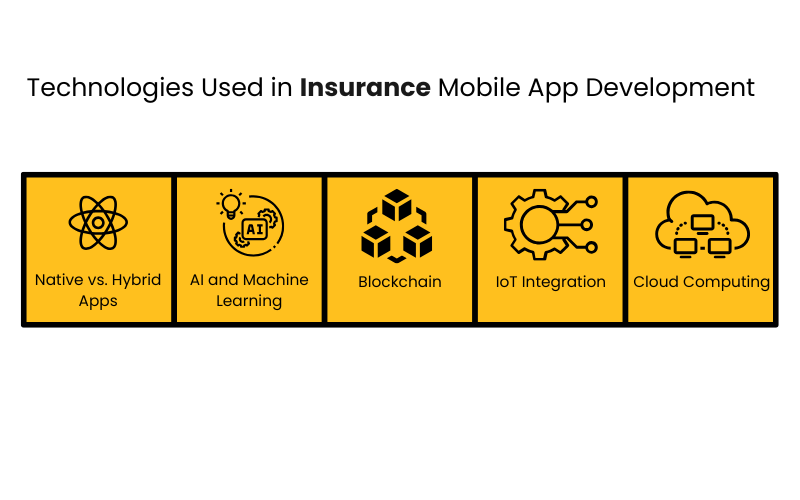

Technologies Used in Insurance Mobile App Development

The development of an insurance app requires several advanced technologies to ensure functionality, security, and scalability. Some of the essential technologies include:

1. Native vs. Hybrid Apps:

- Native apps provide the best performance and user experience but may be costlier to develop as they require separate versions for iOS and Android.

- Hybrid apps can run on both platforms with a single codebase, offering a more cost-effective solution but sometimes at the expense of performance.

2. AI and Machine Learning:

- AI can personalize customer experiences by analyzing user data to offer tailored recommendations, such as customized insurance plans.

- Machine learning algorithms can also help detect fraudulent claims and analyze risk factors more efficiently.

3. Blockchain:

- Blockchain ensures that insurance transactions are secure, transparent, and tamper-proof. It can help track claims and policies, offering greater trust and security to both insurers and customers.

4. IoT Integration:

- IoT-enabled devices like smart home systems and telematics (in auto insurance) can be integrated with the mobile app to track customer behavior and provide personalized premiums based on actual data.

5. Cloud Computing:

- Cloud services help securely store user data, documents, and claims. It enables the app to scale as needed without sacrificing performance or data security.

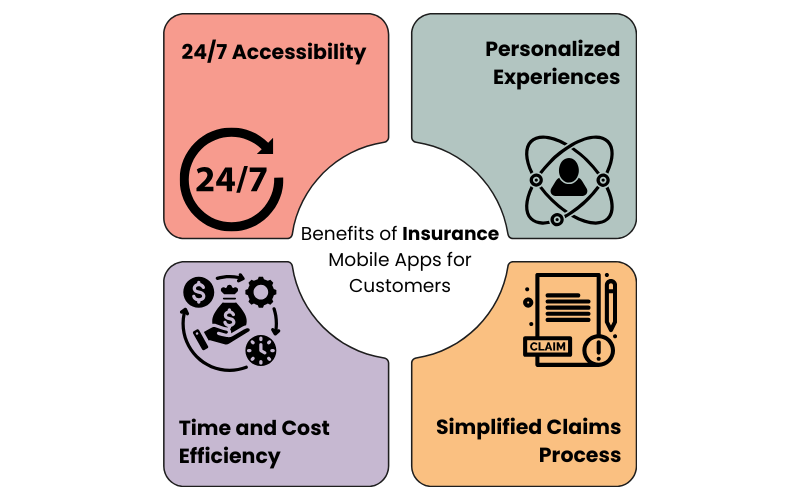

Benefits of Insurance Mobile Apps for Customers

Insurance mobile apps offer multiple benefits for customers. The ease of managing everything from claims to payments directly through their mobile device enhances the user experience.

1. 24/7 Accessibility:

- Customers can access their insurance information anytime, anywhere. They don’t need to rely on office hours to manage their policies or file claims.

2. Personalized Experiences:

- By analyzing user data, the app can suggest personalized insurance plans or discounts based on the customer’s needs and behaviors.

3. Time and Cost Efficiency:

- Customers can save time by quickly getting quotes, paying premiums, or submitting claims without needing to call or visit an office.

- Instant claim status updates and self-service options reduce the need for customer support interventions.

4. Simplified Claims Process:

- Filing claims becomes simpler through mobile apps. Users can upload photos and documents, and track the progress of their claims in real-time.

Benefits of Insurance Mobile Apps for Insurers

Insurance companies also gain significant benefits from developing mobile apps, including increased operational efficiency, better customer engagement, and cost savings.

1. Improved Customer Engagement:

- Mobile apps allow insurers to stay in direct contact with customers through notifications, reminders, and updates, enhancing engagement.

2. Data-Driven Insights:

- Insurance companies can collect valuable customer data to understand user preferences, adjust marketing strategies, and create more personalized services.

3. Cost Reduction:

- By automating tasks such as claims filing and policy renewals, insurers can reduce operational costs and improve efficiency.

4. Enhanced Security:

- With mobile apps, insurers can integrate advanced security measures, such as two-factor authentication and end-to-end encryption, ensuring that customer data remains secure.

Challenges in Insurance Mobile App Development

While developing an insurance mobile app brings numerous advantages, it is not without its challenges. Some of the common issues include:

1. Data Security & Privacy:

- Insurance apps handle sensitive customer information, which makes it essential to ensure that the app complies with industry standards like GDPR, HIPAA, and other data protection regulations.

2. User Adoption:

- Some users may be hesitant to use mobile apps for insurance services, particularly older demographics. Insurers need to focus on user-friendly designs and education to encourage adoption.

3. Integration with Legacy Systems:

- Integrating the mobile app with existing insurance platforms and systems can be complex. Ensuring smooth integration with CRM, policy management systems, and payment gateways is crucial for seamless operation.

4. Keeping Up with Regulations:

- Insurance companies must ensure their apps comply with the diverse regulations in different regions, which can be a challenge when expanding across borders.

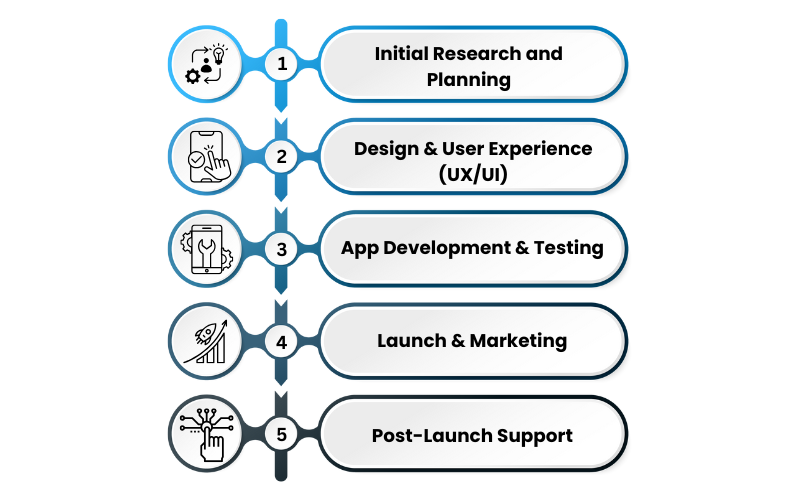

Steps in Developing an Insurance Mobile App

Developing a mobile app for the insurance sector involves several key steps:

1. Initial Research and Planning:

- Conduct market research to understand the target audience, competitive landscape, and essential features required for the app.

2. Design & User Experience (UX/UI):

- Focus on creating an intuitive design that allows users to easily navigate through the app, making their experience hassle-free.

3. App Development & Testing:

- Choose the right platform (native or hybrid) based on your needs and budget.

- Conduct extensive testing to ensure the app is bug-free and meets all performance requirements.

4. Launch & Marketing:

- Launch the app on popular platforms like Google Play and the App Store. Use digital marketing strategies to promote the app and attract users.

5. Post-Launch Support:

- Regularly update the app with new features, improvements, and security patches based on user feedback.

Cost to Develop an Insurance Mobile App

The cost of developing an insurance mobile app varies depending on factors like the complexity of features, the development platform, and the geographical location of your development team. On average, a basic insurance mobile app can cost between $20,000 to $80,000, while more complex apps with advanced features can cost upwards of $100,000.

Future Trends in Insurance Mobile App Development

The future of insurance mobile apps looks promising, with several exciting trends emerging:

1. AI and Chatbots:

- AI-driven chatbots will continue to play a pivotal role in customer service, handling queries and requests 24/7.

2. Blockchain for Transparency:

- Blockchain will provide enhanced security and transparency in transactions, allowing users to track their claims and policies.

3. Telematics and IoT:

- Insurers will continue to integrate IoT devices to track user behavior, offering personalized premiums based on real-time data.

4. Voice Assistants:

- Voice-controlled assistants like Alexa or Google Assistant will be integrated into insurance apps, allowing users to interact with their insurance information hands-free.

5. Wearable Technology Integration:

- Health and life insurance apps will increasingly integrate with wearable devices to provide health data for better premium calculations.

Conclusion

Insurance mobile app development is a game-changer for the industry, offering both businesses and consumers unparalleled convenience, efficiency, and security. By leveraging the latest technologies, insurers can stay ahead of the curve and deliver superior services to their customers. If you’re looking to develop a cutting-edge insurance mobile app, SilverWebBuzz can help you create a customized, user-friendly solution tailored to your business needs.